Submission Pro - Cloud

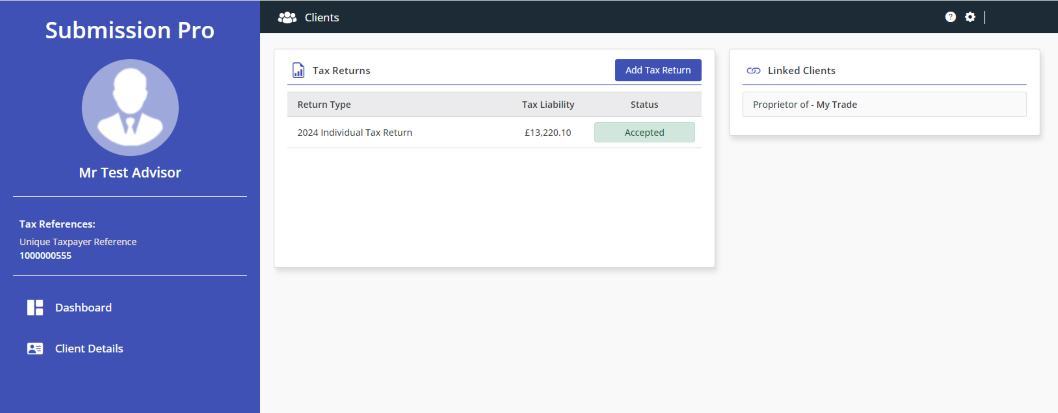

Tax software in the cloud

Tax software for agents & individuals

Cloud based software, simply designed to improve the process of managing your tax return preparation and calculations of tax, from data entry to submission directly to HMRC.

Sign up and try the free evaluation, no credit card required.

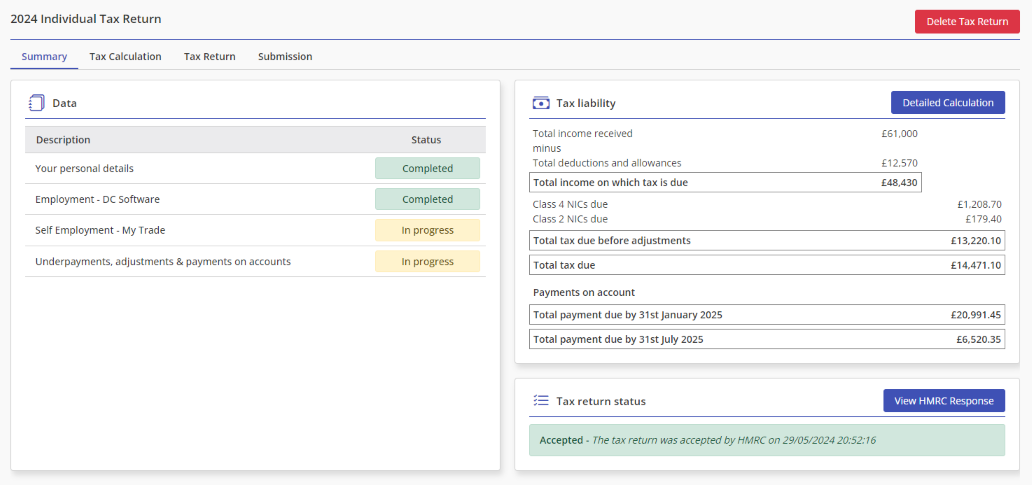

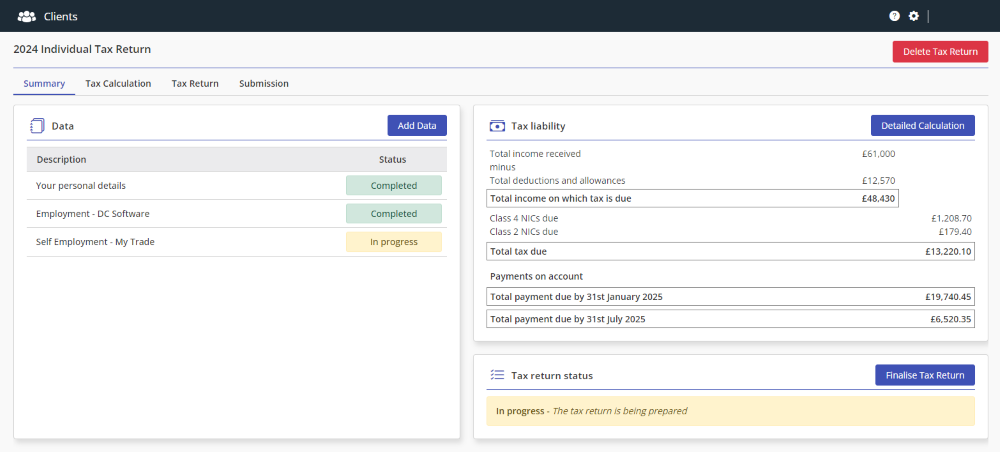

Individuals & Partnerships

Simplify and manage your tax return preparation, calculations of tax and online submission of returns to HMRC.

Trusts

Streamline your tax process with simplified preparation, automated tax calculations for your Trust tax liability, and direct online submission to HMRC.

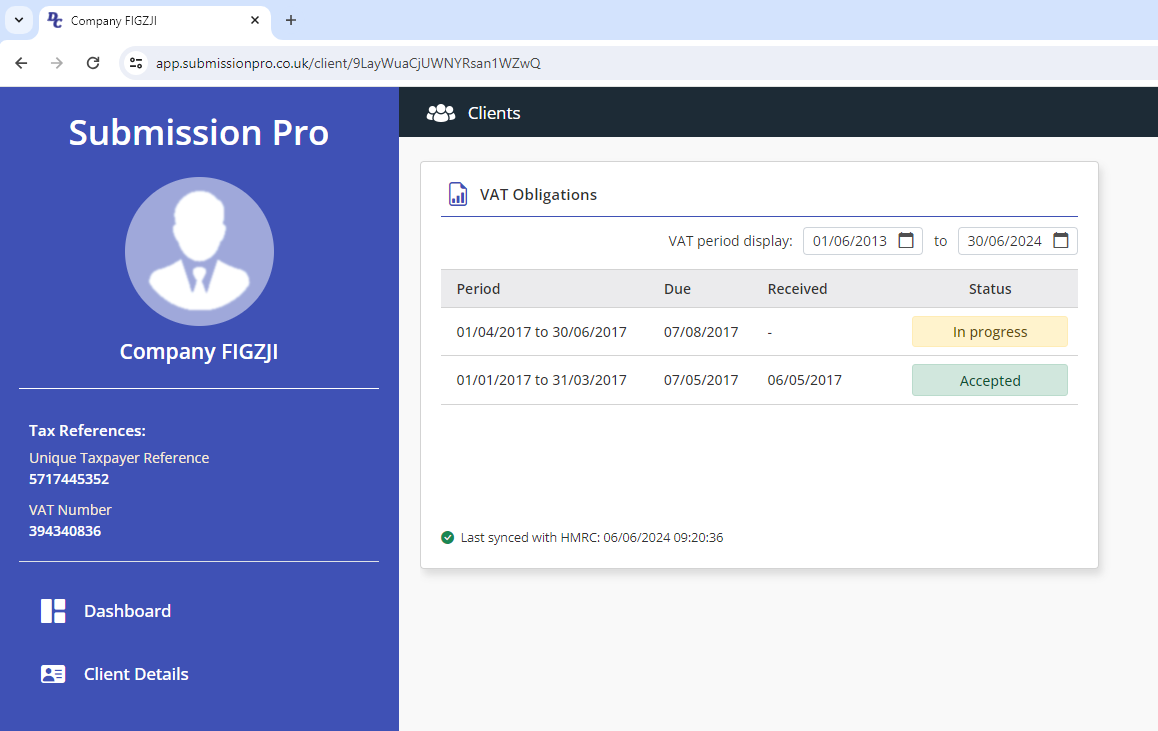

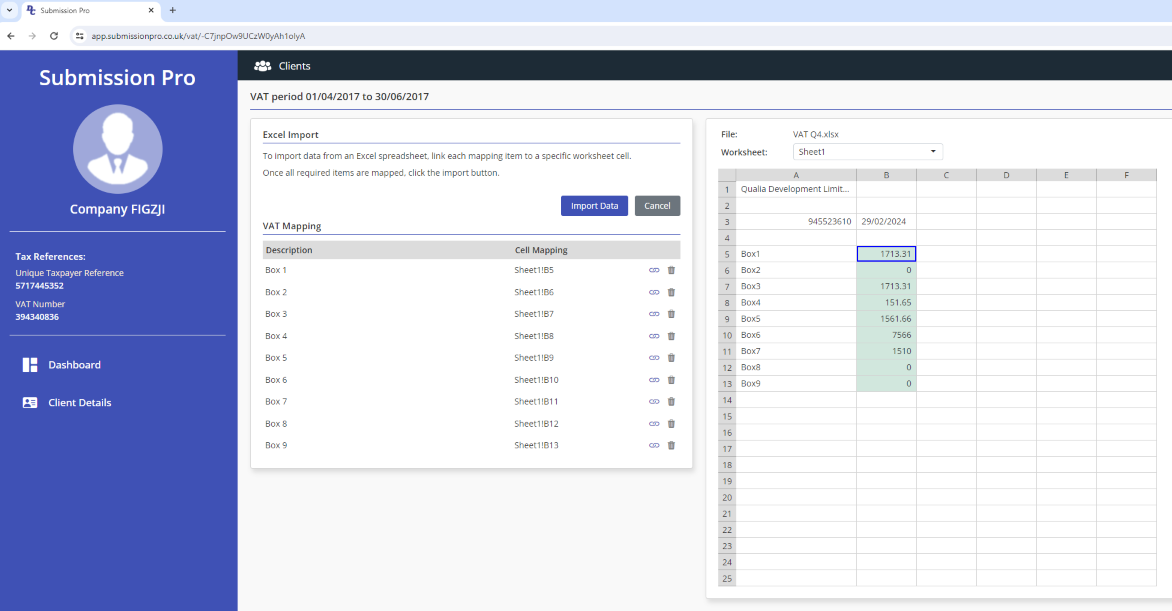

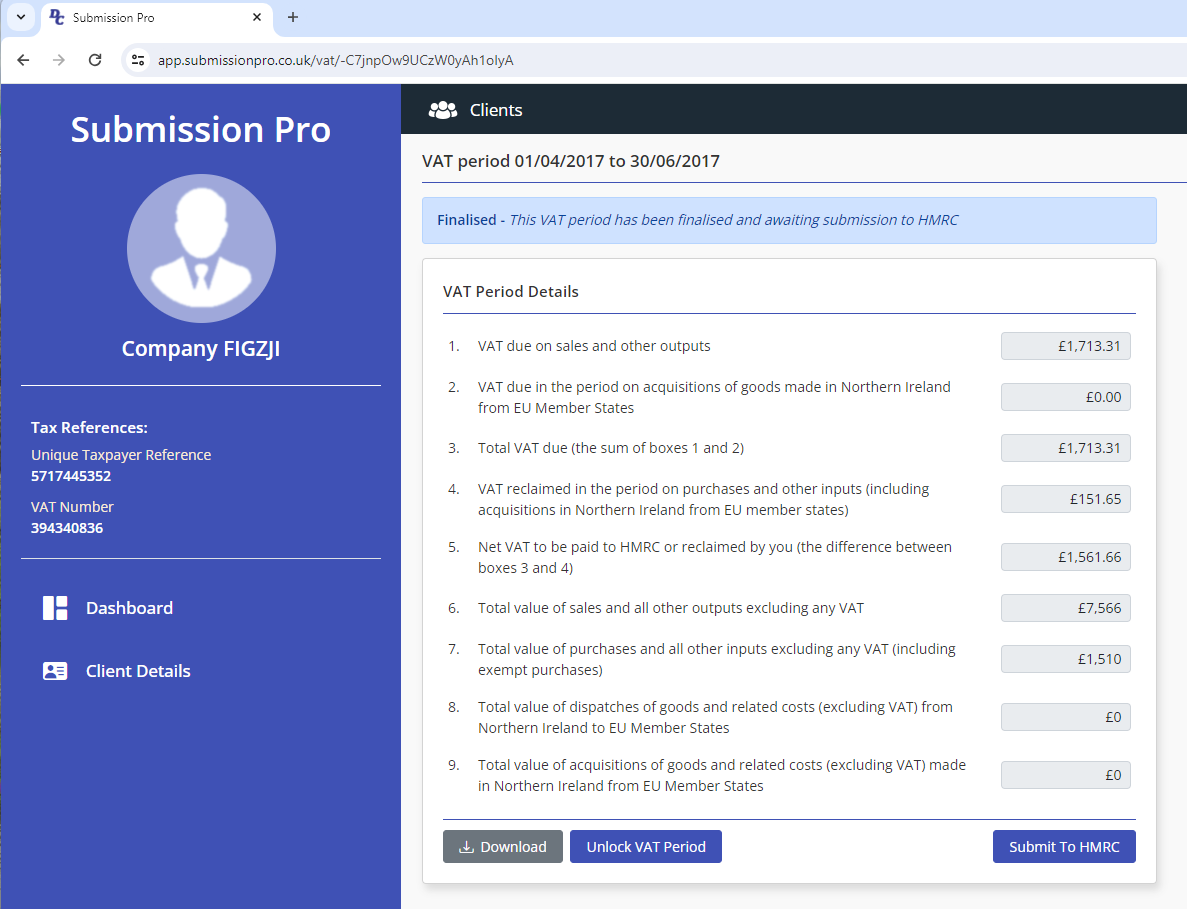

MTD for VAT

Upload & import your VAT period data from any Excel spreadsheet and submit directly to HMRC's new MTD service.

HMRC recognised software

Data entry for all available data sources, including Self-employment, employment, property, partnership income, foreign income, trusts, capital gains and non-residency.

Print directly onto HMRC forms.

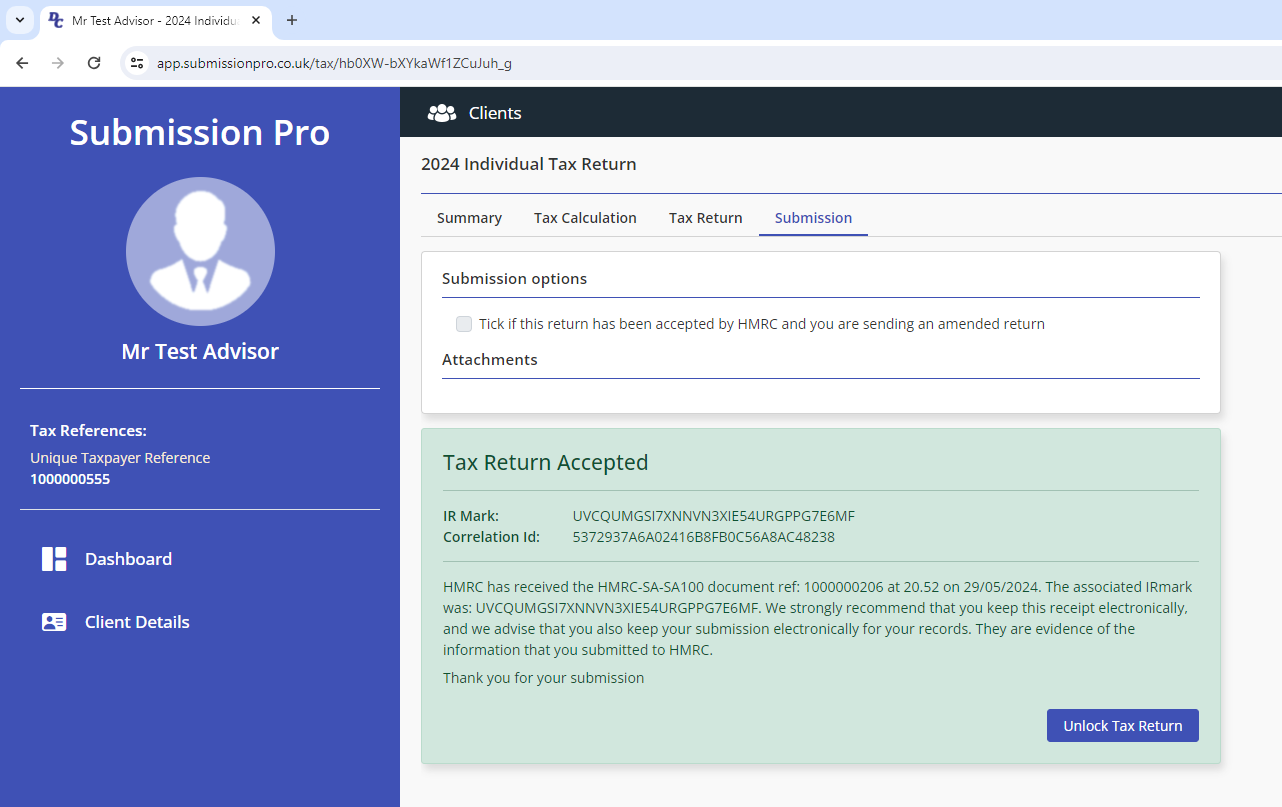

Submit VAT periods, tax returns or amended returns directly to HMRC.

Security

Encrypted data transfer of data in line with the latest security standards.

ISO 27001 certified high-performance UK data centres.

Isolated database instance per customer.

Enable two-factor authentication for added security.

All prices are for a 12 month licence and include VAT

Individuals & Partnerships

Licence

Price

1 client

£30

2 clients

£55

Up to 5 clients

£65

Up to 10 clients

£80

Up to 25 clients

£150

Up to 100 clients

£210

Unlimited clients

£260

MTD for VAT

Licence

Price

1 business

£25

Up to 10 businesses

£75

Unlimited businesses

£160

Trusts

Licence

Price

1 client

£35

Up to 10 clients

£80

Unlimited clients

£150